Getting in a car today? Before you do, consider this: one in seven drivers doesn’t have insurance. Either they can’t afford it, or they neglected to pay their bills. Why is that your problem? Well, imagine getting hit by one of them … and then getting slammed with the bill.

For decades, I’ve watched clients deal with the aftermath of car accidents. It’s devastating. Through no fault of their own, they face serious injuries and loved ones’ deaths. And if the other driver is uninsured or underinsured, my clients have to shoulder the financial burden. Some even go into debt.

It shouldn’t be that way. I’m constantly telling everyone I know: make sure you have enough insurance. A good policy can make the difference between getting good health care and getting a huge bill. The law requires you to have a certain amount of coverage, but in many accidents, the bare minimum doesn’t cover the damage.

So how much is enough to protect yourself? Well, as much as you can afford. I’ll explain. Let’s start with the different types of coverage:

Personal Liability Coverage

What is it? If you hurt someone, your insurer will pay him or her for the injury.

How much do I need? Indiana law requires you to be insured for $25,000 per person and $50,000 per accident. As you can imagine, the damages can easily exceed these minimums if you hurt another driver or passenger.

Property Damage Coverage

What is it? If you break something, your insurer will pay for the damages.

How much do I need? Indiana law requires you to be insured for $10,000. If you just have the bare minimum and total someone’s $20,000 car, you could easily be liable for $10,000 out of pocket.

Medical Payments Coverage

What is it? If you or your passengers get hurt, your insurer will pay for the medical bills, including deductibles and co-pays. This applies whether or not the wreck is your fault.

How much do I need? Legally, nothing. But if you get in an accident and don’t have medical payments coverage, you’ll probably wish you had it.

Uninsured and Underinsured Motorist Coverage

What is it? If another driver injures you or your passengers and doesn’t have insurance (or doesn’t have enough), your insurer will pay for the damages.

How much do I need? Again, the law doesn’t you require to get this type of insurance. And again, that doesn’t mean you don’t need it.

I recommend $100,000 to $300,000 of personal liability, uninsured, and underinsured motorist coverage and $10,000 of medical payments coverage, at the very least. This is more than the law requires you to have, but it doesn’t actually cost much more.

If you can afford it, go a step further. You’re better off with $250,000 to $500,000 of personal liability, uninsured, and underinsured motorist coverage and $10,000 of medical payments coverage, plus a $1,000,000 umbrella policy with liability, uninsured, and underinsured coverages.

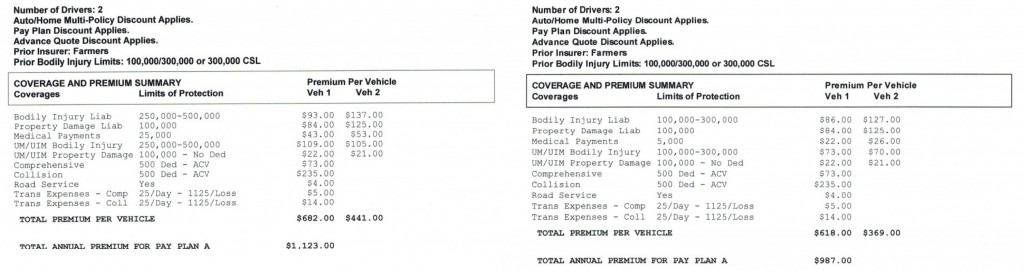

Believe it or not, the difference in price between these policies is pretty small. Compare these two quotes:

As you can see, the difference between these policies is small. Overall, the two people on this insurance policy quote would each spend about an additional $5 per month for a stronger policy. Small price to pay for $420,000 more of coverage.

The cost of your auto insurance depends on accident history, car make and model, age, gender, location, and other factors, so you could end up spending more or less than this. It’s always a good idea to compare various policies to see how much extra protection costs.

Getting hit by an underinsured driver is my worst nightmare. If I’m killed, I want my family to be taken care of. And if I’m living but seriously injured, I don’t want them to be slammed with medical bills. That’s why my wife and I have a robust insurance policy for ourselves and our daughter.

A car accident is bad enough without adding medical and car repair bills to the equation. But many of my clients realize too late that their insurance policies don’t cover enough.

So please, take another look at your insurance policy. Ask questions. Do research. And make sure you have enough.