I am not an insurance agent. I don’t sell insurance. And to tell you the truth, I really don’t like insurance companies. But if you have an automobile, it’s a necessary evil. Here’s my advice: if you are buying automobile insurance for yourself, buy as much as you can afford. Seems contradictory, but let me explain.

If you want to drive a car legally in the United States, the law requires two things (1) a license and (2) insurance. Think about it. Every state in the country has laws that legally require drivers to buy insurance. Wouldn’t you love to be able to sell a product or service that the large majority of the adult public is legally mandated to buy? No wonder we see so many commercials for auto insurance (think Gecko, Flo, Discount Double Check, Mayhem).

Back to my point, why do I say buy as much as you can afford? Well, when you purchase automobile insurance there are several different coverages. Indiana law requires:

- Personal Liability coverage: if you hurt someone with your car, then the insurer pays the hurt person. You must have a minimum of $25,000 per person /$50,000 per accident in coverage.

- Property Damage coverage: if you break something with your car, then the insurer pays for the damage, repair, or replacement. You must have $10,000 in coverage.

The rest are optional coverages, which typically include:

- Medical Payments coverage: if you or a passenger in your car is hurt, then the insurer will pay the medical bills up to their limit – regardless of whose fault it is. No deductibles. No co-pays.

- Uninsured Motorist Coverage: if you or a passenger in your car is hurt in a wreck (that was not your fault) and the driver did not have any insurance (1 in 7 drivers do not), then the insurer will pay for all of your damages up to the limit.

- Underinsured Motorist Coverage: if you or a passenger in your car is hurt in a wreck (that was not your fault) and the driver did not have enough insurance (1 in 7 drivers do not), then the insurer will pay for all of your damages up to the limit, as long as your limits are higher than the other driver.

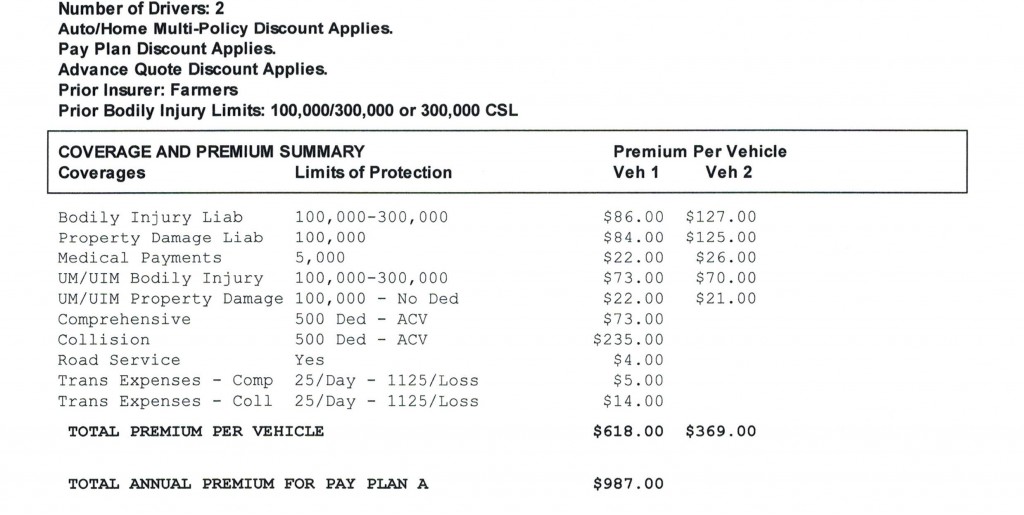

My recommendation to anyone is buy $100,000/$300,000 of personal liability, uninsured, and underinsured motorist coverage and $10,000 of medical payments coverage – at the very least.

Here is an example:

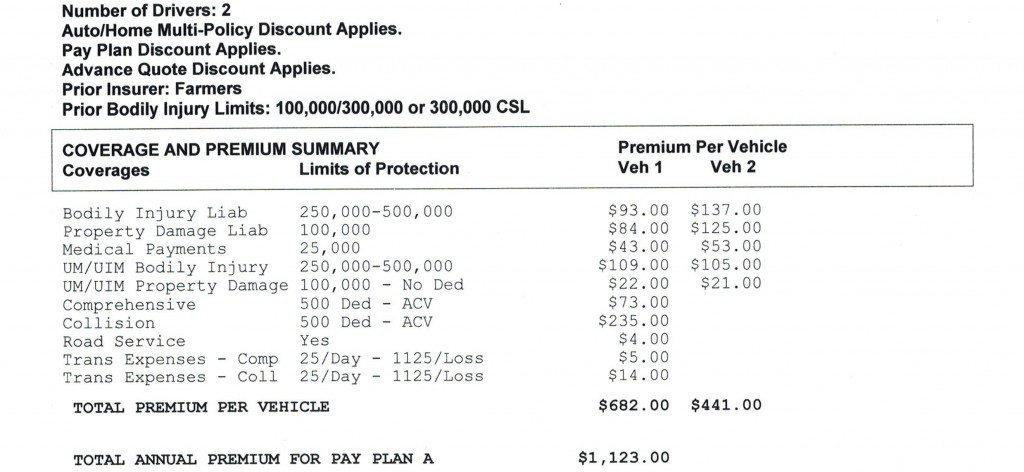

However, the best insurance package would be $250,000/$500,000 of personal liability, uninsured, and underinsured motorist coverage and $10,000 of medical payments coverage PLUS a $1,000,000 umbrella policy with liability, uninsured and underinsured coverages (an umbrella policy costs about $250-300 a year).

Here is an example:

What you can see in comparing the two examples above is that uninsured, underinsured, and medical payments coverage is relatively cheap and this is the insurance that covers you in case you are hurt in a wreck with someone who does not have any or not enough insurance.

I see far too many sad cases of my clients who have been in wrecks – through no fault of their own – and they are seriously hurt or even killed and the driver at fault does not have any insurance or just the state minimum. It happens every day. My worst nightmare is that someone will run a red light and seriously injure me or kill me. If the other driver does not have insurance or not enough, then I want my family to be taken care of with my policy. That is why I buy as much insurance as I can afford. And it’s relatively cheap.

(Image via allstate.com)